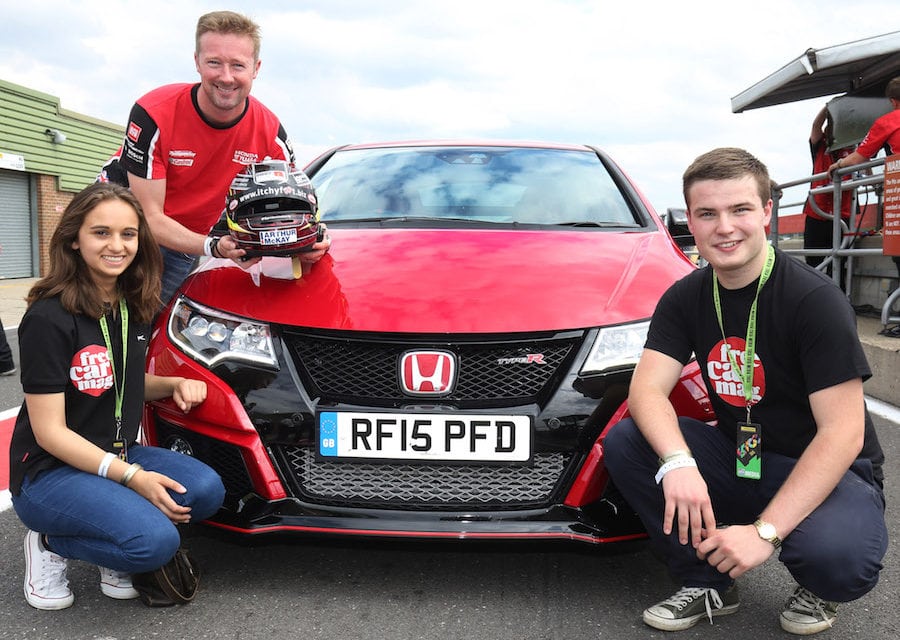

(picture, Free Car Mag staffers and very young drivers pictured with a Honda Type R and BTCC champion Gordon Shedden.)

Here is an issue close to Free Car Mag heart as we have been involved in arranging teenager insurance. It is also the question we get asked the most from readers, how can I cut my teenager’s insurance quote? However, there is one thing we certainly would not recommend and that is ‘fronting’. Indeed, not having parents named on the insurance once the teenagers gets their licence is a huge help in cutting the premium. Anyway, let’s see what he expert research from the AA has discovered.

According to new research from AA Insurance, nearly half of drivers believe that it is acceptable to reduce car insurance premiums for young drivers by insuring the car in a parent’s name, naming a young driver as a ‘named driver’.

This is known as ‘fronting’ – where a named driver on a policy is the person driving the car most or all of the time.

And alarmingly, 1% of drivers considered it acceptable to drive without any insurance in order to avoid high young driver premiums.

This comes at a time when the Financial Ombudsman * is featuring a fronting case-study following a customer complaint, which it did not uphold and in its latest report the ombudsman notes the significant proportion of young consumers’ complaints that are motoring-related.

Michael Lloyd, the AA’s insurance director, points out that ‘fronting’ has long been an issue for car insurers but it is regarded as fraud.

“The cost of insurance for a new, young driver is often eye-watering,” he agrees, “so it’s understandable that families might want to look for ways to cut that cost.

“For many people, a parent insuring a youngster’s car and adding them to the policy as a ‘named’ (or occasional) driver might seem to be a legitimate way to get costs down but they may not recognise the potential consequences.”

According to the latest AA British Insurance Premium Index, the typical quoted premium for someone aged 17-22 is £1,436, more than double that for someone aged 30-35 but for a newly qualified driver, with no no-claim bonus, it could be much higher than that.

Lloyd points out: “A quarter of young drivers (23%) aged between 17-24 will have a crash within two years of passing their driving test thanks to a combination of youth and inexperience.** They are also much more likely to be in collisions that involve death and serious injury.

“That’s why their first couple of years’ premiums are so high.”

Populus asked over 24,000 drivers about their attitude towards insuring a young person’s first car***.

Almost half (49%) said that they consider insuring the car in a parent’s name in order to reduce the cost to be acceptable and would help the young driver pay for the cover.

Perhaps reflecting that it is usually mum who will add a youngster as a named driver, women were more likely (53%) than men (46%) to do this.

60% of those aged 17-22 considered this an acceptable way to obtain cover.

Regionally, those in Northern Ireland (57%) and London (50%) were most likely to consider ‘fronting’.

The consequences of a young person whose parent has ‘fronted’ the insurance policy can be extremely serious, including prosecution for fraud.

If an insurer is satisfied that fronting is involved they are likely to cancel the policy from inception, as if it never existed.

Nevertheless, the insurer must still meet third party costs which could run into many thousands of pounds if there are injuries and can seek to recover their third-party costs from the family.

Often such costs can’t be recovered and have to be absorbed by the insurer, which ultimately finds its way to premiums paid by everyone.

However, insurers are increasingly alert to the issue and will question families where they believe that an attempt at fronting is being made or may price cover on the assumption that the young person driving most of the time.

The AA has called on the government to cut Insurance Premium Tax (IPT) for young drivers using telematic insurance. Says Lloyd: “Young drivers using telematic (‘black box’) insurance which tracks driving behaviour are around a third less likely to be involved in a crash.

“Young drivers suffer disproportionally from the 100% increase in IPT that will have happened by 1st June, in less than two years. If IPT was cut completely for them, it would save up to £300 on a typical first premium for an 18-year-old and would discourage parents from taking extreme and illegal measures to cut costs, such as fronting.”