You must have trucking insurance in place to operate your trucking company. It serves as a measure of protection for your business, your truck drivers, the cargo, and everyone else on the road.

Trucking insurance is customizable and based on your needs. As such, the costs can vary widely, particularly when considering the following factors affecting your insurance rates.

Type of Cargo Hauled

If your trucking company specializes in hauling hazardous or valuable cargo, there are greater risks involved during transport. You will likely have higher premiums to cover any potential losses when you haul flammable items or luxury goods.

Experience and Age of Your Truck Drivers

Truck drivers who have many years of experience and clean driving records will keep trucking insurance rates lower. There is a greater risk when you hire those with less experience or anyone with a history of traffic violations.

Trucking Company Driving Record

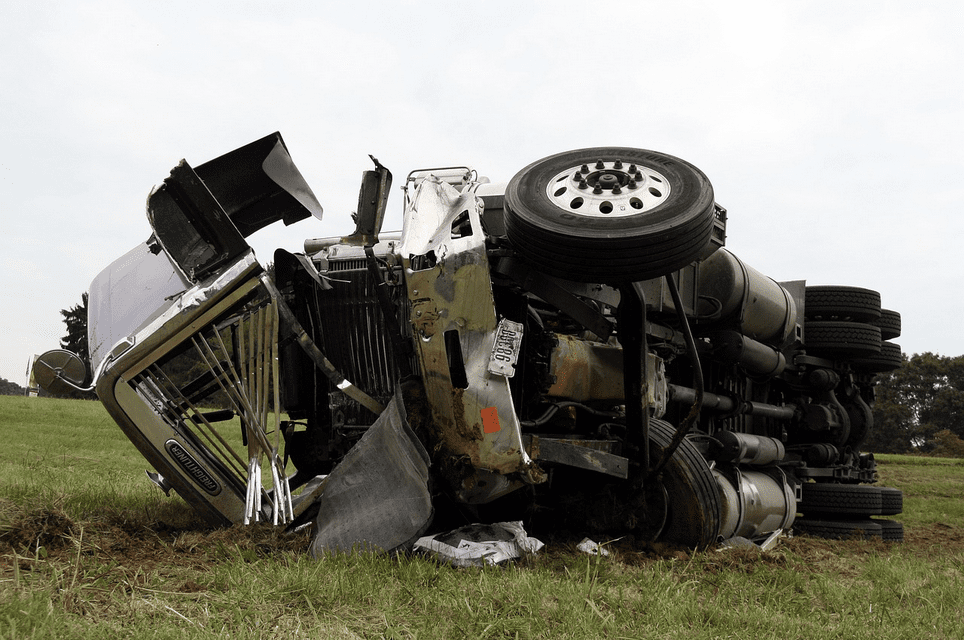

In addition to the driving record of each truck driver on your payroll, the record for your trucking company also may impact how much you pay for trucking insurance. Trucking insurance providers examine the total number of violations, accidents, and claims over a certain period. If you have frequent incidents, you can expect a higher rate.

Age and Condition of Your Trucking Fleet

There are many ways the trucks your company uses can affect your insurance rates. When you have newer trucks that are well-maintained, they are considered safer. They are also less prone to breaking down, and hence, less likely to cause accidents.

Location of Your Trucking Business

Certain geographic regions may have higher accident rates or trouble with theft and cargo damage. This can impact your trucking insurance costs, though areas that have more regulations can add more to your insurance policy.

What Can You Do to Reduce Your Trucking Insurance Rates?

You must have trucking insurance to operate your trucking company. It’s a huge cost of doing business. However, even with rates continuing to rise across the board, you can do a few things to help reduce your premiums.

One of the best ways to lower these costs is to attract and employ experienced truck drivers. Look for drivers who have at least two years of CDL experience since insurers find that experienced truckers are less likely to make mistakes.

Additionally, keeping your DOT safety record clean is another way to keep insurance premiums much lower. You should maintain your trucking fleet and ensure proper inspections are completed. Avoid hiring drivers who have a history of drug or alcohol abuse or those who lack the proper qualifications.

Using newer trucks can also lower these insurance rates for your trucking company. When all other options have been exhausted though, it may be prudent to choose higher deductibles, especially if you have a low number of accidents on record. Ultimately, these solutions can help you get a lower insurance rate for your trucking business when you know what factors affect these rates.

Image: https://pixabay.com/photos/semi-accident-crash-truck-2659732/