As someone passionate about cars, hitting the open road in your ride isn’t just a hobby—it’s a lifestyle. But, as every car enthusiast knows, the thrill of full-throttle can really rev up your monthly budget. Between fuel, maintenance, insurance and unexpected repairs, those expenses can feel like a roadblock to enjoying your vehicle says Oscar Collins.

The good news is that with some creativity and planning, you can keep your costs in check without sacrificing your love of driving. Here are some ways to budget for your monthly driving expenses to stay behind the wheel and ahead of your finances.

Car insurance is a necessity for any car owner. However, paying more than you can afford monthly to keep your car safe is far from a necessity. Shopping around for a premium you can afford is essential to save money.

Doing your research can help you find a premium that matches your budget and your needs. Finding an insurance company that fits your needs could save you a ton of money monthly.

Try combining your car and home insurance if you have it. Adding your car to your home insurance premium might bring down the cost of both because the insurance company is adding more to your portfolio.

You can also see if your insurance company offers safe-driving discounts — in many cases, all you have to do is install an app on your phone and follow safe driving practices for you to enjoy savings.

Although routine maintenance might feel like a chore, keeping up with it could help avoid more significant incidents later on. Ensuring you check your oil, radiator coolant and wiper fluid often is one way to keep your car going longer.

Your tires, steering fluid and brake fluid are also essential items to check monthly. Getting your car serviced every 3,000 miles will ensure that it gets the attention needed to keep it running smoothly.

If you choose to neglect these small but significantly important aspects of car maintenance, it might result in much larger issues later on that will cost much more than the maintenance costs.

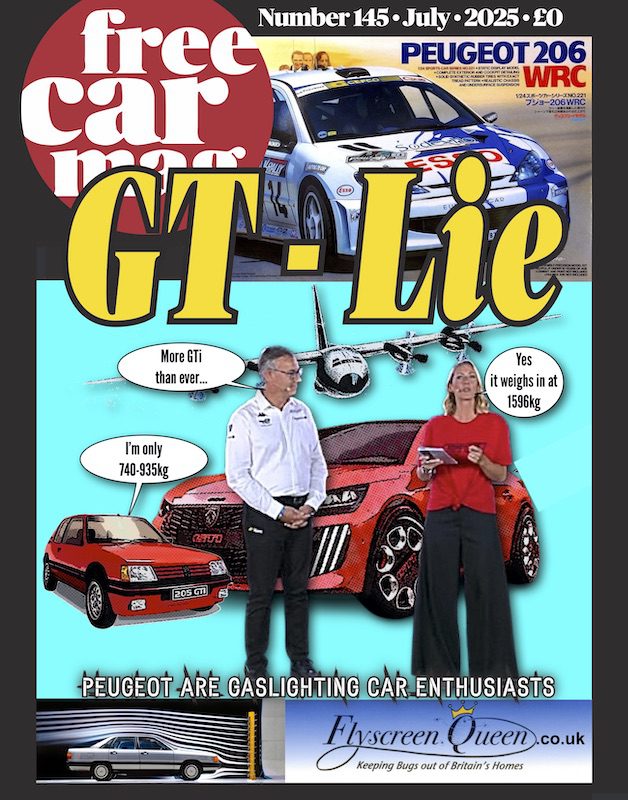

While maintenance and insurance are great ways to ensure your car’s safety, fuel efficiency is a great way to save some money. Every car’s fuel efficiency is different, so you must determine how to get the most out of your vehicle.

Driving long distances will improve your car’s fuel efficiency while driving in town will decrease it. Other than your driving habits, there are many small ways that you can save fuel. Doing this will allow you to keep the extra money you would spend on fuel in your pocket.

If you travel in the same direction as the same people often or you work with someone who lives near you, try starting a carpool. This will benefit everyone involved in the carpool.

Not only will a carpool save you fuel, but it will also save the wear and tear your car would undergo. As a bonus, you won’t be lonely traveling as you’ll have people to talk to on the journey.

Carpools require a certain level of honesty and commitment, though. You must keep others in the carpool updated on your situation and establish a way to divide expenses so things run smoothly. Being considerate will make the experience more pleasant for everyone.

When possible, use public transportation to get around instead of using your car. While you’ll be spending money to take the bus or a train, long-haul journeys are far cheaper on public transportation.

Using public transportation selectively can save you money and reduce the wear and tear your car experiences. Think of it as giving your car a few extra weeks’ life each time you choose public transportation for your long-haul trips.

Parking tariffs and tolls seem insignificant costs but can build up over time. If you regularly park in a paid parking spot or pay tolls, consider changing your locations to save money.

The occasional parking tariff won’t break the bank, but if you use a paid parking spot every day at work, you’re going to rack up quite the bill over the course of a couple of months.

Drive Smart, Save More

Budgeting for your driving expenses doesn’t mean giving up the joy of being behind the wheel. With thoughtful strategies like comparing insurance rates, staying on top of maintenance and maximizing fuel efficiency, you can cruise through each month without financial bumps in the road.

Small changes add up, and the more intentional you are, the further your budget and love for driving will take you.

Author Bio: Oscar Collins is the editor-in-chief of Modded. He has over five years of experience writing in the auto space, having published with Automotive News, Carwash and InAutomotive. Follow him on X @TModded for frequent updates on his work.